09/11/2019 | Ironwood Insight

Access to Capital for Growing Businesses

On September 11, 2019, Ironwood Capital and Valley Bank co-hosted a Capital Strategies program in Tampa, Florida at Armature Works. Additional co-sponsors of the event were Hill Ward Henderson, KLH Capital, RSM US LLP, and Skyway Capital.

Over 30 local businesses attended the event to learn more about the strategic capital options available to growing private businesses.

“Ironwood Capital developed the Capital Strategies program several years ago. Our goal is to increase awareness among business owners considering a sale, acquisition, expansion, partner buyout or refinancing. We want them to know there are a variety of tailored solutions available to help them achieve their goals,” said Alex Levental, managing director at Ironwood Capital, who provided an introduction to the program. “The point to be driven home is that all private equity deals are not the same, and while money is abundant right now, advisor/partner selection and transaction structure are critically important to the ongoing success of the businesses you have built,” shared Levental.

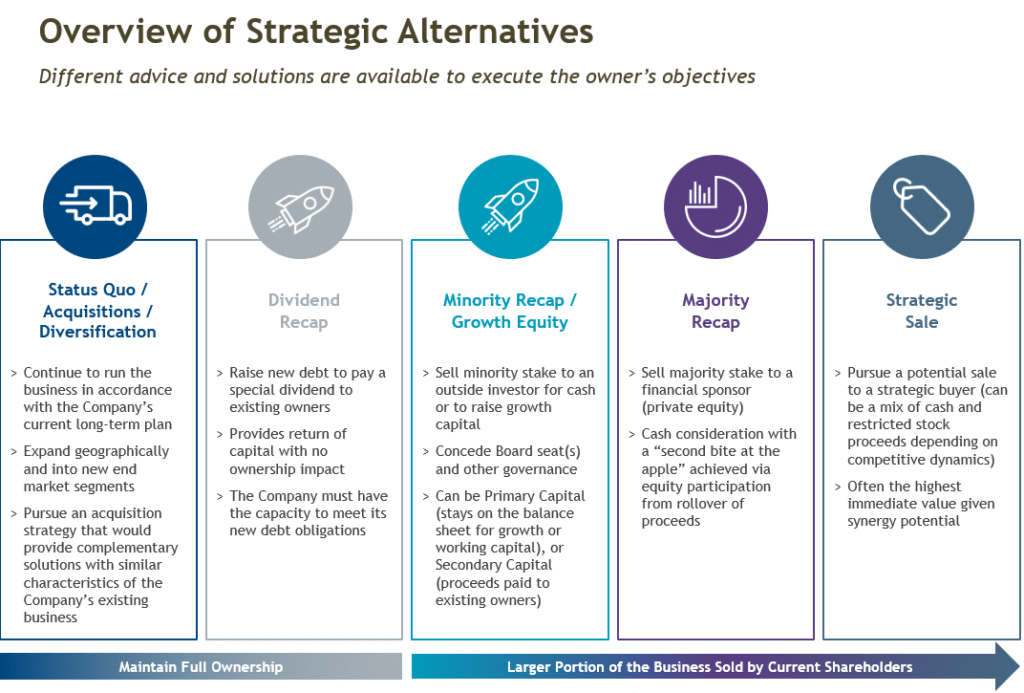

The program is geared to middle-market business owners, chief financial officers and their legal advisors. Panelists explore how a company should prepare itself to enter the market for capital, how to prepare for an exit or recapitalization, recent market trends and the range of financial products available such as senior debt, subordinated debt, private equity and venture capital. Panelists also cover situations where each type of capital is most appropriate. The event concludes with a question and answer session.

Tampa Capital Strategies panelists, from left to right,; Dave Felman, shareholder, Hill Ward Henderson, P.A.; John Lisi, Tax Partner, RSM US LLP; Ron Ciganek, senior vice president, Valley Bank; Michael Johnson, managing director, Skyway Capital Markets; Kyle Madden, partner, KLH Capital; Paul Witinski, director, Ironwood Capital; and moderator Danny Jackson, director at RSM US LLP. Ron Ciganek also provided welcoming remarks.

Alex Levental, managing director at Ironwood Capital, providing the program introduction.

Prior to the panel discussion, attendees networked over breakfast.